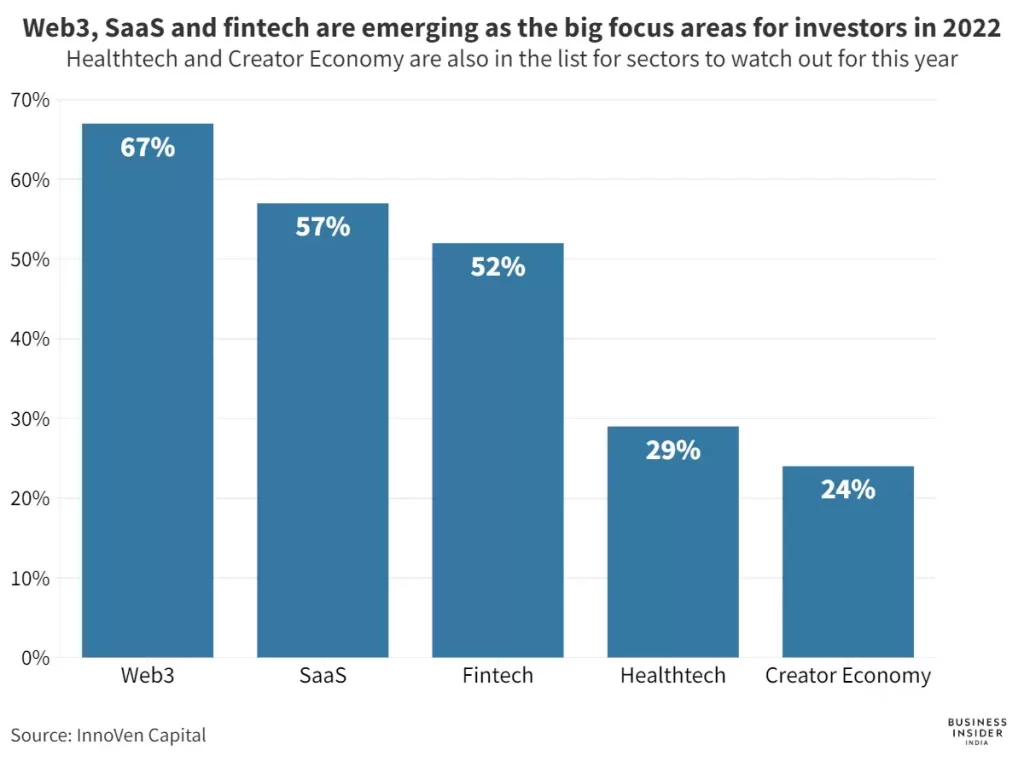

Canva/BI India expects to invest heavily in Web 3.0, SaaS, and fintech by 2022. According to a report by InnoVen Capital, seven out of ten respondents anticipate that Web 3.0 will be a fiery topic in 2022.

According to recent research by InnoVen Capital, Web 3.0, software-as-a-service (SaaS), and fintech are emerging as significant priority areas for investors in 2022.

According to the report, over seven out of ten respondents, or 67 per cent, believe that Web 3.0 will be something to watch out for. Six out of ten respondents believe SaaS will be a strong performer this year, and five respondents expect big things from the financial industry.

Web 3.0 is the most recent version of the Internet, which uses machine learning, artificial intelligence, and blockchain to enable real-time human communication.

Healthtech and the Creator Economy are two other sectors to watch in 2022. Over 29% of respondents (three out of ten) voted for health tech, and 24% voted for the creative economy.

3one4 Capital, Blume Ventures, First Cheque Ventures, Indian Angel Network, India Quotient, Kae Capital, Mumbai Angels, Omnivore, Orios Venture Partners, Waterbridge Ventures, Good Capital, and YourNest Capital are among the early-stage institutional investors who contributed to the research.

Five out of ten respondents predict that early-stage investment will slow down in the following years. This will be disheartening to observe, as early-stage investment has been picking up steam recently.

“Early-stage investment activity has proven to be resilient in 2021 with bigger transaction sizes at higher valuations and an increase in the number of Angel Syndicates which are all clear indicators of a maturing early-stage ecosystem. Although the market sentiment shows muted hints of slowdown, we expect the early-stage funding environment to remain strong,” Tarana Lalwani, partner at InnoVen Capital India, said.

In 2021, seed and pre-Series A round raised about half a billion dollars in India, compared to $365 million the previous year. In addition, the transaction size increased from 243 in 2020 to 316 in 2021.