- Propelld works with educational institutes to increase learner’s tuition fee affordability by providing customized loan products through a fully digital loan journey.

- Funds from the round will be utilized to further strengthen in house tech and collection capabilities, while introducing new financing products and building distribution capabilities across segments.

Delhi, February 18, 2022: Propelld, an education focused fintech platform has raised $ 35 million in Series B funding round led by WestBridge Capital along with existing investors - Stellaris Venture Partners and India Quotient. Founded in 2017 by IIT Madras trio of Bibhu Prasad Das, Victor Senapaty and Brijesh Samantaray, Propelld has tie-ups with over 550 educational institutes and is currently clocking an annual loan disbursal run rate of Rs. 600 Cr.

With the current funding round, Propelld plans to grow the loan book rapidly in a segment with low credit penetration, and offer new products for various verticals within education. Currently employing around 150, Propelld plans to add another 100-150 employees over the next year across technology, business development and collections.

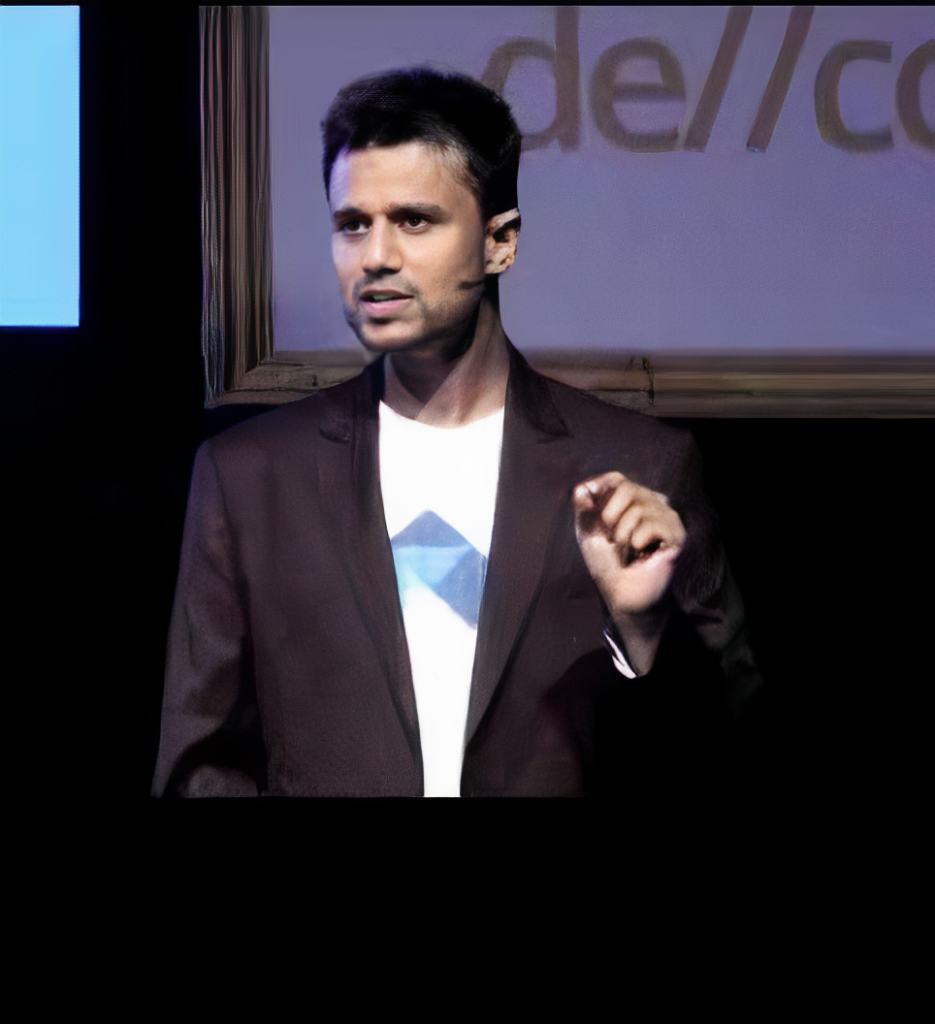

Speaking on the fundraise, Bibhu Prasad Das, Co-founder, CEO at Propelld, said,“We would like to thank all our institute and lending partners who have believed in us. With the latest capital infusion we will strive towards building better financial products for the educational ecosystem which will further benefit our partners. “

" India spends over USD 90 Billion annually in education, however the financial penetration is still very low. Propelld aims to address this gap and increase education loan accessibility to students through tech based products. We believe Propelld will become the go-to financial player in the Education domain just as we’ve seen strong vertical-focused financial players in other domains like Affordable Housing, SME Lending, Consumer Durables etc.Propelld is already profitable and has consistently maintained excellent credit quality”-

Deepak Ramineedi, Partner, WestBridge Capital

“We’ve seen Propelld put their heads down and grow sustainably while being very vigilant about lending fundamentals, even during the last couple of Covid-affected years where the broader financial services industry and fintech in general had large disruptions. Their NPA numbers, revenue, and profitability gives us a very strong belief in the fundamentals of the company.” – Anand Lunia, Partner – India Quotient

“We have been very impressed with the team that Propelld has been able to put together and their execution capabilities. Also exciting for us is how the team has thought about leveraging technology from the ground up in all aspects of the company’s operations which is one of the secret sauces of them being highly efficient.”

Ritesh Banglani, Partner - Stellaris Venture PartnersWith a strong foothold in the Ed-tech, Up-skilling, and Job-focused market, Propelld plans to expand its operations in other education segments too.

*Disclamier: "The pages slugged ‘Press Release’ are equivalent to advertisements and are not written and produced by Industry Outreach Magazine journalists/Editorial." We do not hold any copyrights towards the content or image. Image source: Newswire